Renato Rodic

NMLS# 1615600

Call or Text: 480-307-4107

Let’s get you started with a faster, easier, cheaper mortgage 👇

Renato Rodic

NMLS# 1615600

Call or Text: 480-307-4107

Let’s get you started with a faster, easier, cheaper mortgage 👇

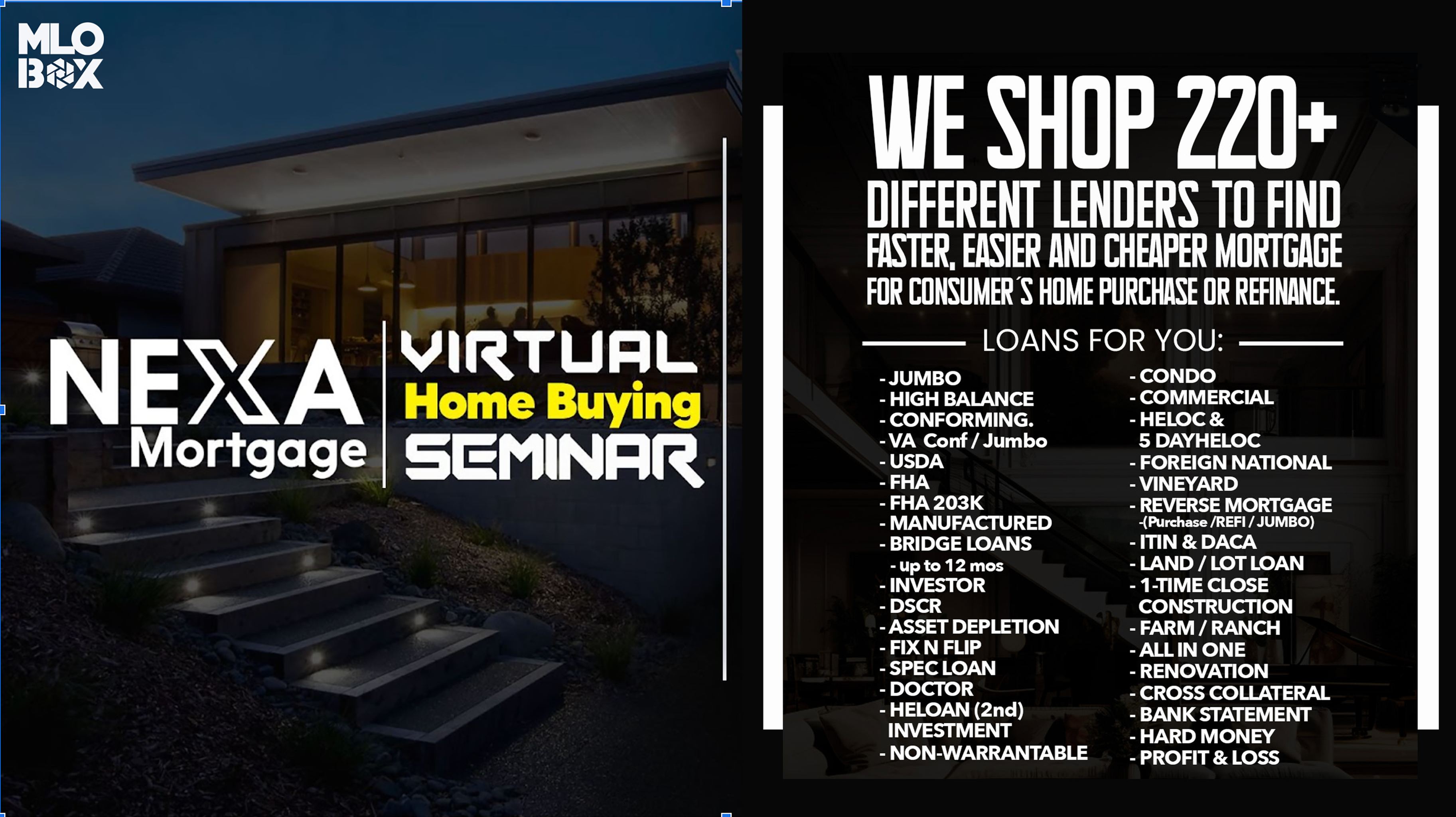

Whether you’re just starting out or ready to close, our home-buying workshop offers everything you need to know as you prepare to buy a home:

✅ Understand your costs upfront

✅ Determine a price range that’s comfortable for you

✅ Find out how a real estate agent can help you

✅ Learn how your credit score can impact your loan

✅ Organize paperwork for a smoother loan process

[ajax_load_more container_type=”ul” post_type=”post” post_format=”standard” placeholder=”true” progress_bar=”true” progress_bar_color=”ed7070″ archive=”true” repeater=”template_34″ posts_per_page=”4″ ]

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply.

Copyright © 2024 | NEXA Mortgage LLC

Licensed In: AZ, NMLS # 1615600 | NMLS ID 1660690 | AZMB #0944059

Corporate Address : 3100 W Ray RD STE 201 Office # 209, Chandler AZ 85226

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

We don't charge any lender fees, saving you on average $1,600 over retail banks.

We make sure the numbers work before running your credit.

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

We don't charge any lender fees, saving you on average $1,600 over retail banks.

We make sure the numbers work before running your credit.

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

We don't charge any lender fees, saving you on average $1,600 over retail banks.

We make sure the numbers work before running your credit.

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

We don't charge any lender fees, saving you on average $1,600 over retail banks.

We make sure the numbers work before running your credit.

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

We don't charge any lender fees, saving you on average $1,600 over retail banks.

We make sure the numbers work before running your credit.

Nexa Grew 926% in 2019 (went from 42 to 389 loan officers in 2019 and we just hit 500th LOs as February 28th 2020 ) 756 Los joined Nexa Mortgage till No

NEXA offer super low interest rates Stop saying you sell service and not rates, when you and I both KNOW you can sell low rates AND service (processing, loan scenario, marketing, even AE’s and UW support from our top lenders ALL One Click away.

Grow your brand with MLOBOX.

✅ Your own branded Website.

✅ Your Own Graphic Designer Team!

✅ Personalized Businesss cards, Flyers & More..